34+ How much can i can borrow mortgage

5 FAQs on Getting a Mortgage in Spain. Your total interest on a 1000000 mortgage.

Trucking Company Letterhead Free Template In Psd Company Letterhead Template Company Letterhead Letterhead Template

Once you know the monthly payment you can afford you can use a mortgage calculator to see what mortgage amount and down payment can get you to that monthly payment amount.

. Mortgage rate refers to the interest rate on your mortgage. For example if youre using the 25 post-tax rule and you bring home 5000 per month that means sticking with a mortgage payment of up to 1250. Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. This is the prescribed cap on loan amounts you can borrow for conforming loans. Lenders generally prefer borrowers that offer a significant deposit.

To be able to borrow a 200k mortgage youll require an income of 61525 per year. For example if you can afford a mortgage payment of 1650 you might only be sending 1326 toward your actual mortgage each month after paying 104 for insurance and 220 for property taxes. A standard valuation fee alone can be between 200-500.

You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. These expenses eat away at how much home you can afford. In this case you dont pay any taxes on this distribution.

Note that your monthly mortgage payments. The income you need is calculated using a 200k mortgage on a payment that is 24 of your monthly income. It pays to find a home and mortgage deal you can afford.

If this is the maximum conforming limit in your area and your loan is worth 600000 your mortgage can be sold into the secondary. The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. Along with the down payment this is probably one of the two biggest factors that determine how much you can afford.

The IRS generally allows you to borrow up to 50 of your vested loan balanceup to 50000with a payback period of up to five years. Please get in touch over the phone or visit us in branch. In this example the lender would be willing to offer a loan amount of 171000.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year. Residents can generally borrow up to 80 of the propertys assessed value whereas non-residents are limited to 6070 LTV. Before you invest 300k into a home youll want to be sure you can afford it.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. The setup fees for the new loan can cost between 300-1000.

534 pa. You can calculate your mortgage qualification based on income purchase price or total monthly payment. Please be aware that this is only an indication of how much you could borrow.

This calculator shows how much you pay each month each year throughout the duration of the loan for each 1000 of mortgage financing. If a house is valued at 180000 a lender would expect a 9000 deposit. Furthermore methods like statistical modelling in a Bayesian framework see eg.

Mortgage rates are determined by your lender and can be fixed or adjustable. The mortgage affordability calculator uses your salary details to give an idea of how much you may be able to borrow. The income you need is calculated using a 300k mortgage on a payment that is 24 of your monthly income.

To be able to borrow a 300k mortgage youll require an income of 92287 per year. This calculator adds in discount points loan origination fees and closing costs along with any recurring PMI fees into the loans original APR to figure out the effective cost of your loan with all these. Borrow from the bank at a real interest rate of.

How long would you like your mortgage for. 51 How much can the bank lend you for your mortgage. It can get expensive so its best to prepare more funds.

Thats about two-thirds of what you borrowed in interest. Conforming limits may be lower or higher depending on the location of the house. How Much Can You Afford to Borrow.

Borrow from her 401k at an interest rate of 4. Refinancing a mortgage can be costly however these costs can be recouped over time if youre refinancing to a loan with a lower interest rate. How much income do I need for a 200k mortgage.

At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 71612 a month while a 15-year term might cost a month. The actual amount is based on a number of things including your salary credit rating and how much you can afford to repay after all your. The discharge fee will generally cost between 100-400.

But if you are still shopping for a chattel mortgage you can use estimates to get an approximate repayment amount. Go to site. Before you invest 200k into a home youll want to be sure you can afford it.

Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate. Monthly payments on a 150000 mortgage. This means they can stay the same or change over the life of the loan.

Heres a breakdown of what you might face monthly in interest and over the life of a 150000 mortgage. Please select 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years 36 years 37. How much income do I need for a 300k mortgage.

The loan amount refers to the. Thanks for your comment. FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment.

Harvey Trimbur and van Dijk 2007 Journal of Econometrics can incorporate such a range explicitly by setting up priors that concentrate around say 6 to 12 years such flexible knowledge about the frequency of business cycles can actually be included. They typically request at least 5 deposit based on the value of the property.

18 Hilarious Texts From Terrible Neighbors Funny Texts Bad Neighbors Funny Text Conversations

Pin On Irish Eyes Are Smiling

A Comfortable Car Funny Texts Funny Text Conversations Funny Text Messages

Tables To Calculate Loan Amortization Schedule Free Business Templates

The Best Carts And Bars For A Home Coffee Bar You Ve Got To See Swankyden Com Coffee Bar Home Coffee Bar Home Coffee Stations

House Plan 402 00971 Luxury Plan 3 397 Square Feet 3 Bedrooms 3 5 Bathrooms Luxury House Plans Luxury Plan House Plans

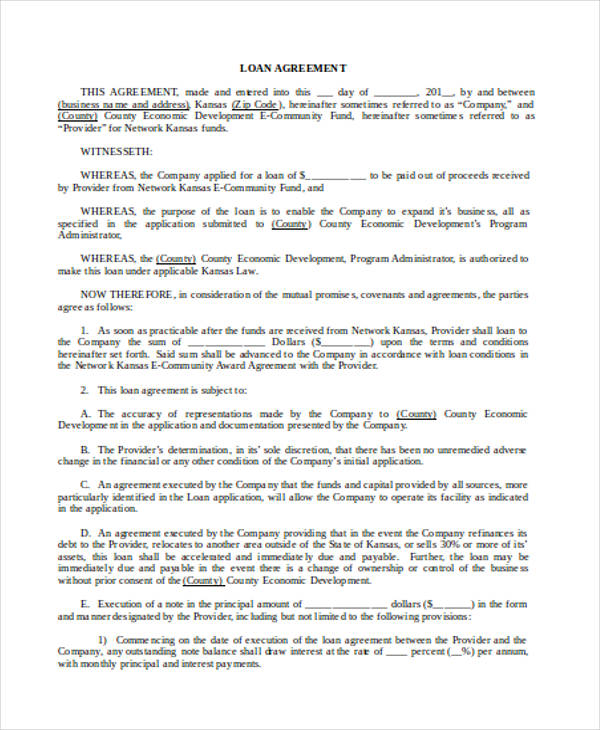

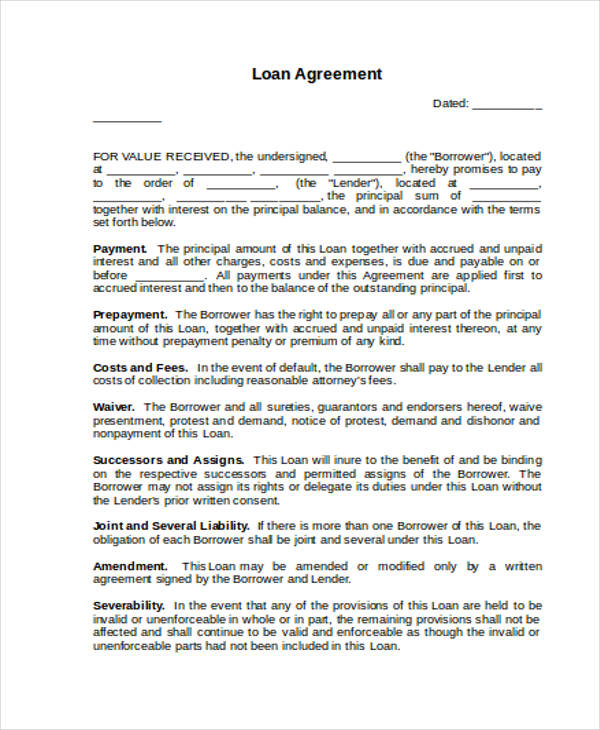

Free 34 Loan Agreement Forms In Pdf Ms Word

Tables To Calculate Loan Amortization Schedule Free Business Templates

Free 34 Loan Agreement Forms In Pdf Ms Word

Tables To Calculate Loan Amortization Schedule Free Business Templates

See You Around Funny Texts Funny Texts Jokes Bad Neighbors

25 Hilarious Text Messages Between Neighbors Funny Texts Funny Text Conversations Very Funny Texts

Quickbooks For Restaurants A Bookkeeping And Accounting Guide A Must Have Quickbooks Guide For Restaurant Ow Bookkeeping And Accounting Bookkeeping Quickbooks

Free 34 Loan Agreement Forms In Pdf Ms Word

Breakup Burrito Funny Text Messages Funny Texts Funny Texts Crush

Tables To Calculate Loan Amortization Schedule Free Business Templates

Pin On Bitchy Word Quotes